Are Banks Still Lending?

Australia’s lending environment has been a rapidly shifting landscape over the last four years.

While cash rates have come to an all-time low, APRA have initiated various restrictions to mainly cool Sydney’s strongly performing housing market. The banking watchdog introduced new prudent restrictions in 2014, reducing the growth of investment loans to 10% per annum.

Effectively, these actions encouraged new lending guidelines for banks, leaving some hopeful borrowers unable to secure finance. The big four banks (NAB, CBA, ANZ and Westpac) were forced to include limitations on serviceability, giving borrowers new hurdles to clear in hopes of securing loans. This has left first home buyers and property investors alike with the question:

Are banks still lending?

The reality is, banks and non-bank institutions are still lending (after all it is their main source of income) but you may require a financial professional’s aid to successfully navigate the new lending landscape. If you asked anyone who has tried to secure lending on their own this question, they would probably tell you no. This portion of borrowers would have found the market exceedingly difficult to navigate without insider knowledge.

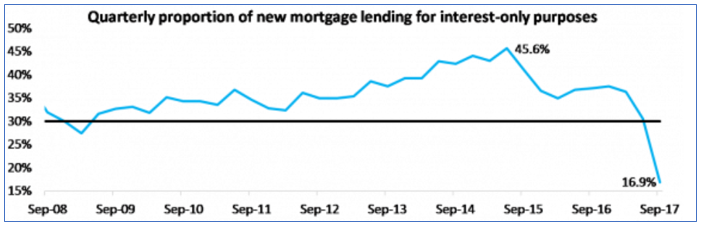

Recently, the portion of interest only lending dispersed by banks has tapered downward. In the Quarter 3, 2017 only 16.9% of new mortgages were interest only loans, down from 33.9% in the previous year. The reality of this data is that the demographic that secures interest only loans are either in a strong financial position or, are assisted by a broker’s expertise – not that banks “just aren’t lending”.

Source: CoreLogic

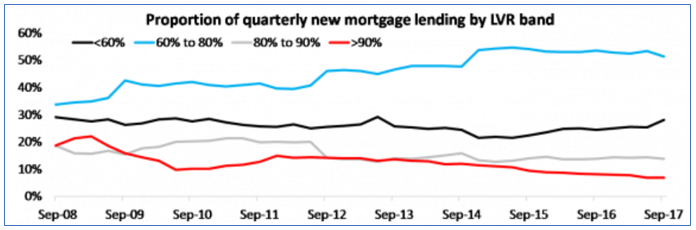

Reports from CoreLogic indicate that there has also been a drop in the lending of high loan to value ratio loans. The number of mortgages that have an LVR of 90% or above have dropped by 13.3% in the twelve months to September 2017. These numbers depict how prudent much of the banking sector has become of recent times, even those who have been able to secure a 10% deposit will be facing some hurdles to borrow.

Source: CoreLogic

However, circumstances are beginning to turn. APRA has realised the impact of these limitations, which now seem to have run their course. In the words of APRA chairman Wayne Byres the restrictions have ‘served their purpose’, after the decision to relax the cap on investor loan growth as of June 1st, 2018. This will mean that banks will look to increase the amount of investment loans over the midterm. In terms of property investment this may mark an opportunity for borrowers within a re-calibrating market, as lending will be increasingly available to those who seeking interest only and investor loans.

Borrowers may start to look at the market with more optimism over the next two quarters. There lies an opportunity as lenders may start to offer deals to gain a competitive advantage in the looming market. Lenders may offer deals in the form of lower rates and more favourable conditions, in attempt to catch rising demand from investors as the market begins to flow more freely. Often this type of competition throughout a lending cycle will spur lenders to top each other. It is in lending environments such as these that a broker’s advice benefit investors as much as any asset decision.

In addition to lending becoming more accessible over the short term, holding a property remains relatively cheap. Low interest rates and strong rental returns have made it progressively easy to cover the costs of investing, with the current conditions creating a sturdy market for potential buyers. In current circumstances it costs as little as $40 dollars per week to hold a $500,000 property – making it easier than ever to hold your investment.

It seems the lending environment is set to shift again over the midterm, possibly in favour of the borrower. The upcoming legislative reforms mark changes in bank lending that will create a stronger position for investors. It is in this environment that buyers should seek the skill set of their finance professionals to understand the market. Obtaining the knowledge of an expert that knows how to appreciate and navigate lenders can mean the difference between good or bad finance outcomes.

Jack Guthrie, Research Analyst - Bluewealth Property

This story first appeared on Bluewealth Property 15 May 2018.