The RBA has cut the official cash rate

The RBA has cut the official cash rate by 0.25% which takes it to 1.25%. Will your bank pass on the full rate cut?

This is the first move in official interest rates since August 2016 but is the 13th rate cut in this rate cutting cycle that started back in November 2011 when rates were 4.75%. (It’s not a new rate cutting cycle as rates have not been raised since they started to fall in 2011.)

This takes the cash rate to a record low 1.25% in the longest easing cycle on record.

Assuming banks cut their rates by 0.25% it will take deposit rates to their lowest since the mid-1950s and headline mortgage rates to their lowest since the early 1950s, although some mortgage rates are already at record lows.

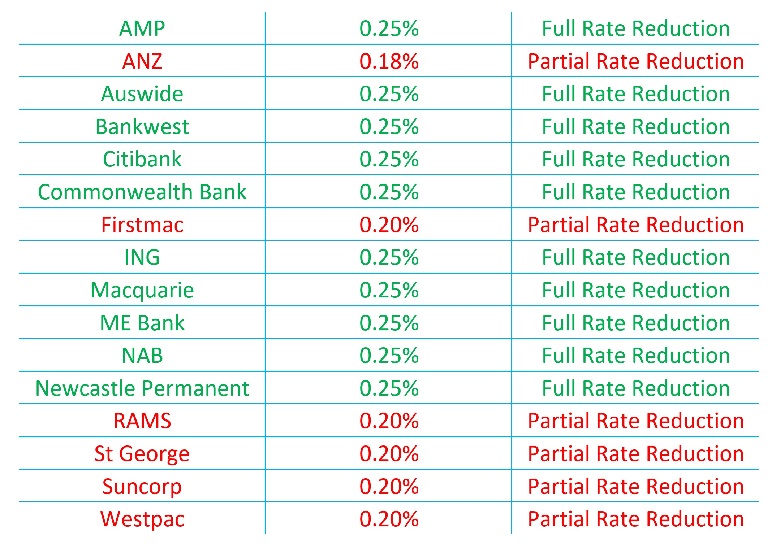

But will the banks pass on RBA rate cuts?

With the recent reduction in bank funding costs meaning that last year’s 0.1-0.15% mortgage rate hikes should now be reversed and nearly 90% of bank deposits on interest rates above 0.5% (and hence able to be cut) we expect most banks to pass on all or the bulk of the RBA’s cut to customers.

Short of a funding cost blow out, the interest rate structure on deposits should allow the bulk of subsequent cuts to be passed through but this may diminish as the cash rate reaches 0.5%.

Did your bank pass on the rate cut?

Do you need to review your home loan? Contact Us.

Important note:

While every care has been taken in the preparation of this article, ADNA Financial Services makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.